The Insurance Market Cycle:

Hard Versus Soft Markets

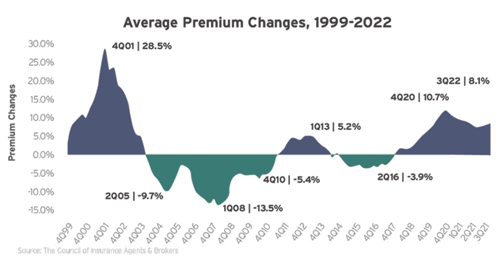

The commercial insurance market is cyclical in nature, fluctuating between hard and soft markets. These cycles affect the availability, terms, and price of commercial insurance.

In what was one of the longest soft markets in recent years, businesses across most lines of insurance enjoyed stable premiums and expanded terms of coverage for decades. While the commercial insurance market hardened for a short period of time after the terrorist attacks of Sept. 11, 2001, the last sustained hard market occurred in the 1980s. However, after years of gradual changes, the market has largely firmed since 2019, leading to increased premiums and reduced capacity.

Factors Contributing to the Hard Market Include:

- Catastrophic (CAT) losses

- The economy

- Mixed investment returns

- The inflation factor

- The cost of reinsurance

- Inconsistent underwriting profits

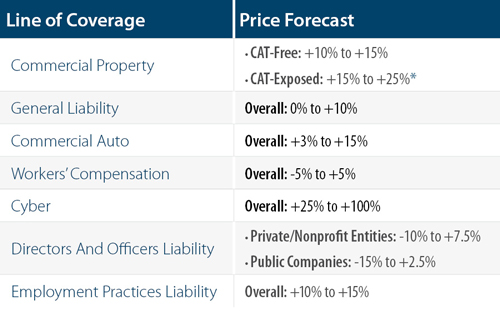

2023 Market Outlook Forecast Trends

Price forecasts are based on industry reports for individual lines of insurance. Forecasts are subject to change and are not a guarantee of premium rates. Insurance premiums are determined by a multitude of factors and differ between businesses. These forecasts should be viewed as general information, not insurance or legal advice.

*Prior to publishing, we received updates from a large wholesaler in the public entity space. The spring of 2023 will likely prove to be one of the most challenging renewal markets ever seen for commercial property.

Significant increases in Statement of Values to compensate for inflation and supply chain shortages combined with rate increases have resulted in premiums soaring as high as 50%

U.S. Property CAT Reinsurance Risk-Adjusted Rates Were Up by an Average of 50%

With Direct Insurance Market, adjustments are being made in Line Size Management. The outcome is the need for more carriers in the program to reach desired excess coverage. Building $25M in limit can take 10+ carriers, whereas it only required 2-4 carriers just a year ago.

Moreton & Company will seek the best rates available. These can fluctuate until the quote is issued. Quotes from carriers are issued 30-45 days out, but even that can fluctuate by carrier and line of business.

Tips for Insurance Buyers

To help curb upward cost trends within your control, we’ll pose just one of many suggestions available for each line of coverage. Narrowing your focus can improve your success.

- Commercial Property: Analyze your organization’s natural disaster exposures. If your commercial property is located in an area that is more prone to a specific type of catastrophe, implement mitigation and response measures that will protect your property as much as possible if such an event occurs (e.g., installing storm shutters on windows to protect against hurricane damages or utilizing fire-resistant roofing materials to protect against wildfire damages).

- General Liability: Ensure your establishment has measures in place to reduce the likelihood of customer or visitor injuries (e.g., maintaining safe walking surfaces and promoting proper housekeeping).

Commercial auto: Prioritize organizational accident prevention initiatives and establish effective post-accident investigation protocols to prevent future collisions on the road. - Workers Compensation: Establish workplace wellness initiatives aimed at preventing or treating chronic health conditions and improving the overall well-being of your staff. These initiatives can help reduce the risk of your workforce developing comorbidities and promote greater employee retention. Additionally, consider incorporating mental health resources and support options within employee wellness offerings.

- Cyber: Consider implementing cybersecurity controls such as multifactor authentication, endpoint detection and response solutions, network segregation and segmentation, remote desk protocol safeguards, end-of-life software management and email authentication technology.

Directors and officers liability: Ensure your senior leaders follow safe financial practices (e.g., timely payments, educated investments, accurate documentation and reasonable reimbursement procedures). Be transparent with stakeholders about your organization’s economic state to avoid misrepresentation concerns. - Employment Practices Liability: Assess your employee handbook and related policies. Ensure you have all appropriate policies in place, including language on discrimination, harassment and retaliation

For More Information

In addition to helping you navigate the insurance market, Moreton & Company has resources to assist in your risk management efforts. Business owners who proactively address risk, control losses and manage exposures will be adequately prepared for changes in the market and will get the most out of each insurance dollar spent.