As we head into the 2nd quarter of the year 2023, it comes as no surprise that, like many other sectors of the economy, the insurance industry experienced further changes to both its market cycles and operating procedures in the last 12 months.

2022 marked the third year of the Pandemic, which has remained a driving factor in various workplace adjustments and associated operational difficulties. We also experienced acceleration of ongoing supply chain disruptions and labor shortages for all sizes of business. Further complicating matters were record-setting inflation trends, inflation, and large-scale international events.

In order for business owners like you to successfully navigate the constantly evolving commercial insurance market, it’s important to consult insurance professionals who understand your business and can help you plan for unique risks and advocate on your behalf. You need insurance professionals who can tell your story to insurance carriers in a way that will best position your business come renewal time.

In these challenging times, Moreton & Company is here to provide the insurance guidance and expertise your business needs.

2023 Market Outlook Forecast Trends

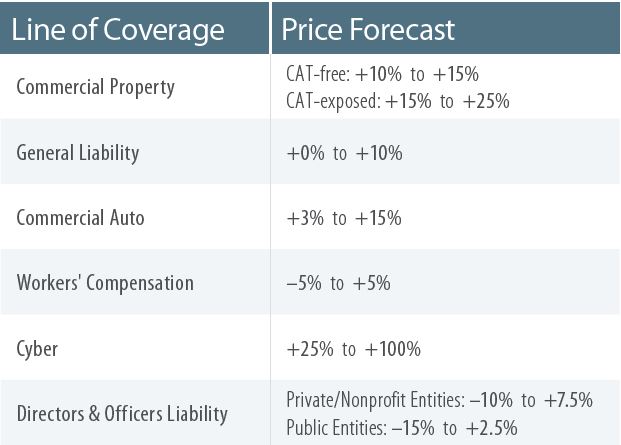

Price forecasts are based on industry reports for individual lines of insurance. Forecasts are subject to change and are not a guarantee of premium rates. Insurance premiums are determined by a multitude of factors and differ between businesses. These forecasts should be viewed as general information, not insurance or legal advice.

Commercial Property Insurance

The past five years have seen the commercial property insurance market progressively harden, evidenced by consistent rate increases since the third quarter of 2017.

Furthermore, some insureds are encountering above-average rate increases and lowered capacity–particularly those exposed to CAT perils (e.g., hurricanes and wildfires). Looking ahead, policyholders who conduct high-risk operations, have poor loss control practices, or are located in natural disaster-prone areas will likely remain vulnerable to persistent rate hikes and coverage restrictions.

Developments & Trends to Watch

Natural Disasters – The surging frequency and severity of natural disasters have continued to pose concerns within the commercial property market.

Supply Chain Struggles – Over the past few years, pandemic-related production and delivery bottlenecks, widespread labor deficits, extreme weather events and geopolitical conflicts have contributed to a range of supply chain struggles.

Inflation Issues – Ongoing inflation issues are also responsible for increased building expenses and valuations.

Insurance-to-Value (ITV) Considerations – An estimated 75% of commercial properties are underinsured by 40% or more, according to industry data.

Reinsurance Capacity Concerns – Current natural disaster and inflation trends have proven particularly difficult for the commercial property reinsurance space to navigate.

Tips for Insurance Buyers

- Conduct a thorough inspection of your commercial property and the surrounding area for specific risk management concerns. Implement additional mitigation measures as needed.

- Work with insurance professionals to begin the renewal process early.

- Gather as much data as possible regarding your existing risk management techniques. Be sure to work with your insurance professionals to present loss control measures you have in place.

- Analyze your organization’s natural disaster exposures.

- Conduct accurate ITV calculations to remain fully protected when covered events occur and avoid potential coinsurance penalties.

- Address insurance carrier recommendations. Insurers will be looking at your loss control initiatives closely; taking the appropriate steps to reduce your risks whenever possible can make your business more attractive to underwriters.

General Liability Insurance

The general liability insurance segment has steadily underperformed over the past few years, generating minimal underwriting profitability due to rising claim frequency and severity. In response, insurance carriers have deployed tightened underwriting standards, reduced capacity, and ongoing rate increases.

Nevertheless, several concerning trends across the segment – including social inflation issues, active assailant exposures and rising medical expenses – still have the potential to threaten claim costs going forward and negatively impact overall market performance.

Developments & Trends to Watch

Social Inflation Issues – The United States has become an increasingly litigious society over the last decade, resulting in businesses facing a growing number of lawsuits following liability incidents (actual or alleged) and, in turn, greater penalties from such legal action.

Active Assailant Exposures – An active assailant incident entails an individual or group of individuals entering a populated area to kill or attempt to kill their victims, generally with the use of firearms.

Medical Expense Increases – Coverage for medical costs arising from third-party injuries is a key element of general liability insurance. As a result, rising medical expenses have exacerbated claim costs across the market in recent years, with no signs of slowing for the foreseeable future.

Tips for Insurance Buyers

- Work with your insurance broker to educate yourself on key market changes affecting your rates and how to respond using loss control measures. Ensure limits match up with your insurance needs.

- Ensure your establishment has measures in place to reduce the likelihood of customer or visitor injuries (e.g., maintaining safe walking surfaces and promoting proper housekeeping).

- Identify and address any completed operations liability exposures and mitigate any product liability exposures (if your organization makes or sells products).

- Create workplace policies and procedures aimed at minimizing active assailant exposures and establishing effective response protocols amid potential incidents.

Commercial Auto Insurance

The commercial auto insurance market has faced substantial underwriting losses and diminished profitability for more than a decade. In fact, a recent report from credit rating agency AM Best revealed that the segment has encountered more than $20 billion in total underwriting losses since 2011. These losses have occurred despite underwriters elevating commercial auto premiums for 45 consecutive quarters, dating back to the third quarter of 2011.

Developments & Trends to Watch

Social Inflation and Nuclear Verdict Concerns – Although social inflation has affected various lines of commercial coverage in recent years, the auto insurance market has been particularly impacted. Specifically, nuclear verdicts have become more prevalent in the segment, especially in as they pertain to bodily injury claims.

Increased Accident Frequency and Severity – In addition to nuclear verdict trends affecting social inflation and claim expenses across the commercial auto market, accident frequency and severity have progressively increased over the past few years, compounding claim costs.

Considerations About Evolving Technology – The last few years have seen vehicles continue to grow more advanced and incorporate new technology (e.g., blind-spot cameras, backup alarms, GPS devices and telematics software), providing opportunities to increase driver safety.

Driver Shortage Challenges – Across industry lines, several workforce movements have led to a challenging labor market.

Tips for Insurance Buyers

- Examine your loss control practices relative to your fleet and drivers. Enhance your driver safety programs by implementing or modifying policies on safe driving and distracted driving.

- Design your driver training programs to fit your needs and the exposures facing your business. Regularly retrain drivers on safe driving techniques.

- Educate employees on driver fatigue and encourage them to take a break if they start experiencing symptoms behind the wheel.

If you have just begun offering delivery services or recently hired new delivery drivers, fully assess the risks associated with these changes and implement measures to minimize potential damages. - Ensure you are hiring qualified drivers by using motor vehicle records (MVRs) to vet drivers’ past experience and moving violations. Disqualify drivers with unacceptable driving records.

- Consider technology solutions, such as telematics, where appropriate to strengthen and supplement other loss control measures.

Implement an employee retention program to maintain experienced drivers. - Prioritize organizational accident prevention initiatives and establish effective post-accident investigation protocols to prevent future collisions on the road.

Workers’ Compensation Insurance

For much of the past decade, the workers’ compensation insurance market has remained stable across states and sectors and produced profitable underwriting results, thus performing as an outlier against other lines of commercial coverage.

Various trends could be contributing to this climbing ratio in the workers’ compensation segment.

Developments & Trends to Watch

Employee Well-being Concerns – Employee well-being refers to the overall state of workers’ physical, mental and emotional health.

Remote Work & Musculoskeletal Disorders – When the COVID-19 pandemic first emerged in 2020, businesses across industry lines moved to remote operations, requiring employees to work from home.

PTSD Among Health Care Workers and First Responders – PTSD is a mental health condition that can develop in people after they experience a very stressful, frightening, or distressing event.

Inflation Issues – This past year has been met with growing inflation concerns, impacting individuals and industries across the board.

- Medical Inflation – This form of inflation refers to rising prices for health care necessities (e.g., medical devices, supplies and

pharmaceuticals). - Wage Inflation – Amid rising cost-of-living expenses and ongoing labor challenges, many businesses have increased their workers’ pay to boost attraction and retention efforts – resulting in wage inflation.

- Comorbidities – A comorbidity is the simultaneous presence of two or more medical diagnoses for an individual. Comorbid conditions are typically long-term health complications that can increase the severity of other injuries or illnesses the affected individual may experience, making it more difficult to recover.

- Wearable Safety Technology – In an effort to minimize employee injuries and subsequent workers’ compensation claims, many businesses have turned to wearable safety technology in recent years.

- Telemedicine – In addition to using technology to help prevent workplace injuries, businesses have also begun leveraging digital capabilities to help employees treat their ailments, improving recovery outcomes and lowering associated workers’ compensation costs.

Tips for Insurance Buyers

- Implement safety and health programs to address common risks, especially when using a loss-sensitive workers’ compensation program.

Conduct routine safety training courses for employees of all ages and experience levels. - Consider implementing various digital solutions – such as wearable safety technology and telemedicine – to help prevent and treat injuries within your workers’ compensation program.

- Establish workplace wellness initiatives aimed at preventing or treating chronic health conditions and improving the overall well-being of your staff.

- Develop an effective return-to-work program that properly supports employees in the process of healing from a work-related illness or injury and resuming job duties following their recovery.

- Develop policies and procedures aimed at helping remote employees make their workspaces more ergonomic and prevent injuries at home.

- Ensure accurate payroll projections. Having correct wage information is critical for conducting accurate premium calculations, especially amid rising inflation concerns. Errors in payroll projections could present serious consequences, such as inadequate rates, insufficient benefits, or a lack of ample coverage following costly claims.

- Pay close attention to applicable state-regulated and carrier-negotiated fee schedules for workers’ compensation coverage. Have clear processes established for handling workers’ compensation claims as diligently and efficiently as possible. Effective claim management protocols can often help mitigate claim severity and prevent similar losses from occurring in the future.

Cyber Insurance

Evolving technology, increased threat vectors, and growing attacker sophistication have continued to drive up both the frequency and severity of cyber incidents, resulting in an ongoing rise in cyber insurance claims and subsequent under-writing losses.

Moving into 2023, industry experts anticipate that difficult market conditions – combined with several new entrants to the segment – will make for an increasingly volatile and unpredictable cyber insurance space. Regardless, policyholders who fail to adopt proper cybersecurity protocols or experience a rise in cyber losses may continue to face rate increases and coverage limitations for the foreseeable future

Developments & Trends to Watch

Increased Nation-state and Supply Chain Threats – Nation-state cyberattacks remain a major concern, especially as the ongoing Russia-Ukraine conflict contributes to global cyberwarfare worries. Because nation-state attacks often arise from third-party exposures, businesses have become more focused on addressing their supply chain vulnerabilities. Amid rising cyberwarfare threats, the following trends have emerged:

- Bolstered Cybersecurity Practices – In March 2022, the White House issued a statement warning U.S. organizations that nation-state cybersecurity exposures stemming from Russian attackers would likely increase in the coming months.

- Additional Coverage Challenges – Apart from elevating their

cybersecurity tactics, some insureds have sought extra coverage to help protect against cyberwarfare risks. But these policyholders have likely faced challenges obtaining such coverage, primarily due to war exclusions. These exclusions generally state that damages from “hostile or warlike actions” by a nation-state won’t receive coverage.

Tightened Underwriting Standards – Similar to last year, cyber

insurance carriers have continued to adjust their underwriting practices to help mitigate the risk of making costly payouts. In particular, the heightened severity of cyber incidents has motivated most carriers to be more selective regarding which organizations they will insure and the types of losses they will cover.

Evolved Regulations – Throughout the past few years, both the federal government and several states have implemented and enforced stricter data privacy and breach notification laws, holding businesses more

accountable for their cybersecurity failings.

Elevated Ransomware and Extortion Concerns – Ransomware attacks, which entail cybercriminals compromising devices or servers and demanding large payments be made before restoring the technology (as well as any data stored on it), have skyrocketed in recent years.

- Ransomware-as-a-Service (RaaS) – RaaS refers to a dark web business model that permits sophisticated cybercriminals to sell their ransomware software to willing buyers (usually less skilled cybercriminals), who then utilize the software to launch attacks and secure ransom payments. When RaaS developers secure buyers, these customers are usually provided with access to not only the ransomware software itself but also some form of a product portal.

- Double and Triple Extortion – Double extortion follows similar protocols to that of typical ransomware attacks; however, it differs in that cybercriminals copy or transfer victims’ data (also called data exfiltration) to deploy an extra threat—victims must pay ransoms not only to regain access to their technology and data but also to keep that data from being shared publicly.

Heightened Business Email Compromise (BEC) Risks – BEC scams involve cybercriminals impersonating seemingly legitimate sources – such as senior-level employees, suppliers, vendors, business partners or other organizations – via email. Cybercriminals use these emails to gain the trust of their targets, tricking victims into believing they are communicating with genuine senders.

Tips for Insurance Buyers

- Work with your insurance professionals to understand the different types of cyber coverage available and secure a policy that suits your unique needs. Start renewal conversations early.

- Take advantage of loss control services offered by insurance carriers to help strengthen your cybersecurity measures.

- Provide remote employees with adequate resources, support, and software to avoid cybersecurity concerns amid work-from-home or hybrid arrangements.

- Focus on employee training to prevent cybercrime from affecting your operations. Employees should be aware of the latest cyberthreats and ways to prevent them from occurring.

- Keep organizational technology secure by utilizing a virtual private network, installing antivirus software, implementing a firewall, restricting employees’ administrative controls, and encrypting all sensitive data.

- Consider implementing cybersecurity controls such as multifactor authentication, endpoint detection and response solutions, network segregation and segmentation, remote desk protocol safeguards, end-of-life software management, and email authentication technology.

- Store backups of critical data in a secure, offline location to minimize losses in the event of a ransomware attack.

- Update workplace software on a regular basis to ensure its effectiveness. Keep employees on a strict software update schedule and consider using a patch management system to assist with updates.

- Establish an effective, documented cyber incident response plan aimed at remaining operational and minimizing damages in the event of a data breach or cyberattack. Test this plan regularly by running through various scenarios with staff. Make updates to the plan as needed.

- Develop workplace policies that prioritize cybersecurity – including an internet usage policy, a remote work policy, a bring-your-own-device policy, and a data breach response policy.

- Consider potential nation-state threats and supply chain exposures when establishing your organization’s cybersecurity policies and protocols.

Directors and Officers Liability Insurance

Although the last few years in the directors and officers liability (D&O) insurance segment were characterized by double-digit rate increases and lowered capacity, market conditions proved much more favorable throughout 2022. This shift was brought on by a range of factors, including new market entrants and fewer litigation concerns stemming from initial public offerings (IPOs) and special purpose acquisition companies (SPACs). In the scope of publicly traded companies, rate increases and retentions moderated substantially – with many policyholders even encountering rate decreases.

While the D&O segment has also started to stabilize for private and nonprofit companies, these companies are still deemed higher risk by insurers than their publicly traded counterparts.

Developments & Trends to Watch

New Market Entrants and Increased Competition – In light of increasing capacity and decelerating rates, it’s clear that insurers’ overall sentiment toward the D&O market has shifted. Looking ahead, insurers are poised to fuel further segment growth, as evidenced by several new entrants in the market and – subsequently – greater competition.

ESG Issues – ESG activism has also made a noticeable impact on the D&O market. Specifically, senior leaders have been held increasingly accountable for upholding their companies’ commitments to environmental and social initiatives by stakeholders, regulators, and the public, thus prompting increased litigation against such leaders and associated D&O claims. Some of this litigation has centered around senior leaders misrepresenting, failing to disclose, or neglecting to effectively address topics such as board diversity, equal pay, and human rights abuse within supply chains.

Global and Economic Uncertainty – Businesses across industry lines (as well as their senior leaders) are facing uncertainty within their operations due to widespread supply chain bottlenecks that have persisted since the initial onset of the COVID-19 pandemic and ongoing international conflicts.

Cybersecurity Concerns – Cyberattacks continue to increase in cost and frequency for businesses of all sizes and sectors, sometimes leading to litigation against senior leaders and related D&O claims.

Litigation Shifts – In recent years, publicly traded companies and their senior leaders experienced a surge in litigation and related D&O claims. Yet, this litigation significantly subsided in certain areas throughout 2022, thus reducing associated claims and costs. Here’s an outline of these litigation shifts:

- Fewer Securities Class Action Lawsuits – A securities class-action lawsuit refers to legal action brought on by a group of shareholders who claim to have suffered financial losses due to the publicly traded company they invested in (and its senior leaders) violating securities laws, such as SEC regulations on ensuring accurate financial statements and disclosures.

- Fewer IPOs and SPAC Deals – A SPAC is a corporation developed with the primary intention of raising investment capital through an IPO – the process of a private company going public by selling its shares on a stock exchange. The secured funds are then utilized to acquire an unspecified business (also called a target company), which is later identified following the IPO.

Tips for Insurance Buyers

- Examine your D&O program structure and limits alongside your

insurance professionals to ensure they are appropriate and take market conditions and trends into account. - Consult insurance brokers, loss control experts, and underwriters to gain a better understanding of your D&O exposures and cost drivers in the market.

- Make sure your senior leadership team carefully assesses potential exposures and maintains compliant, honest practices amid IPOs and SPAC transactions. Pay close attention to SEC requirements for such transactions.

- Ensure your senior leaders follow safe financial practices (e.g., timely payments, educated investments, accurate documentation, and reasonable reimbursement procedures). Be transparent with stakeholders about your organization’s economic state to avoid misrepresentation concerns.

- Make sure your senior leadership team is actively involved in monitoring your organization’s unique cyber risks, implementing proper cybersecurity practices to help prevent potential attacks (especially in the realm of remote work arrangements), ensuring compliance with all applicable data security standards, and establishing an effective cyber incident response plan to minimize any damages in the event of an attack.

- Prioritize establishing eco-friendly initiatives among your senior leadership team. However, ensure that these initiatives remain

realistic to avoid greenwashing concerns. Furthermore, be sure your senior leadership team conducts their due diligence and provides proper reporting regarding climate change concerns.