State of the Market - Property

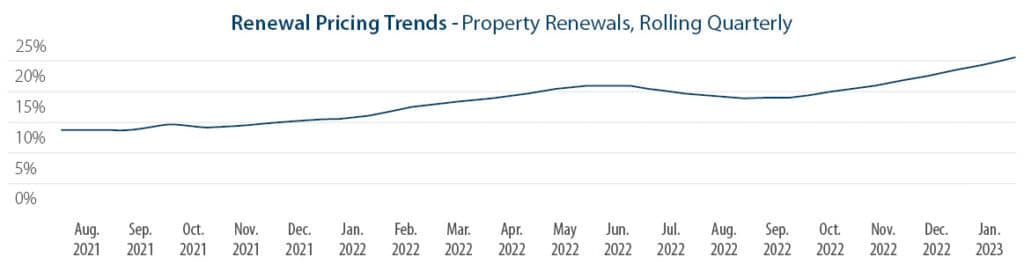

We expect the hard property market to continue in 2023. You have likely noticed insurance carriers indicating that property values have been off as much as 30% or more. Of course, this varies by region and occupancy. As rates and inflation increase, it becomes more important to revisit valuations and increase as necessary to account for “True” replacement cost and current rent price/business income.

Carriers are continuing to offer less capacity, which requires more carriers to complete a large property risk. Carriers are also pushing for higher deductibles.

Almost every industry is seeing property rate increases with the following common contributors:

- Catastrophic weather events–a major hurricane making U.S. landfall in five out of the last six years, wildfires engulfing thousands of acres, unprecedented winter storms, Midwest flooding, etc.–have played a major role in hardening the insurance marketplace.

- Accounts with a large probable maximum loss (PML) and average annual loss (AAL) will continue to be in the spotlight.

- Global inflation and financial and economic uncertainty are causing an increase in the cost of capital, adding to rising rates.

- Reinsurance treaty renewals for 1/1 and 4/1 were as difficult as predicted, with capacity tightening across the board. We anticipate the 7/1 renewals will be just as challenging.